Contents:

The trading method of convergence / divergence of moving averages is used to assess balance of buyers/sellers, strength and direction of trend, as well as the search for turning points. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions.

- When min appears – a weak signal to buy suggests that after breakdown, buyers will be stronger.

- You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

- The SMA is plotted by taking price data from the defined period and producing an average.

- ¶Keltner Channels are a trend following indicator used to identify reversals with channel breakouts and channel direction.

- These indicators both measure momentum in a market, but because they measure different factors, they sometimes give contrary indications.

- Uses both price and volume to measure buying and selling pressure.

Generally, the closer the price is to the upper band, the closer to overbought conditions the charted asset may be. Conversely, the closer the price is to the lower band, the closer to oversold conditions it may be. For https://day-trading.info/ the most part, price will stay within the bands, but on rare occasions, it may break above or below them. While this event may not be a trading signal in itself, it can act as an indication of extreme market conditions.

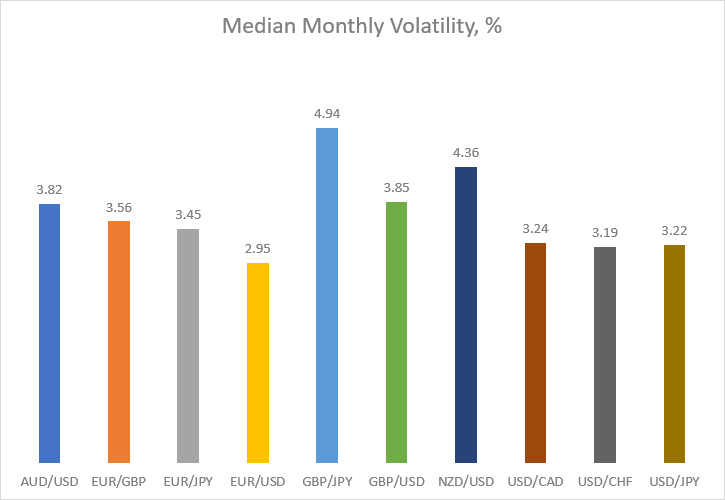

The idea behind selling here is that short-term price movements are no longer following the uptrend, so the trend may be reversing. By default, MACD parameters are offered – optimal for the hourly chart on all popular assets. When setting up, it is necessary to take into account the actual volatility and the analysis period – the more timeframe, the more “long” averages need to be included make your journey to the cloud easy with cloud solutions in the calculation. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. In general, the exponential moving averages are measured according to the closing prices of an asset, and the periods used to calculate the two EMAs are usually set as 12 periods and 26 periods .

Stock Market Graph

First, the MACD employs two Moving Averages of varying lengths to identify trend direction and duration. The histogram is used as a good indication of a security’s momentum. The Klinger Oscillator is a technical indicator that combines prices movements with volume. The indicator uses divergence and crossovers to generate trade signals.

It is positive when the typical price rises and negative when the typical price declines . A ratio of positive and negative money flow is then plugged into an RSI formula to create an oscillator that moves between zero and one hundred. Even though indicators show data, it’s important to consider that the interpretation of that data is very much subjective. As such, it’s always useful to step back and consider if personal biases are affecting your decision-making.

Generally, it tends to be the most useful when near the upper or lower extremes of its range. Indicators are the weapons of choice for battle-tested technical analysts. Each player will choose tools that best fit their unique playstyle to then learn how to master their craft. Some like to look at market momentum, while others want to filter out market noise or measure volatility.

Download Scalper Scanner Mt4 Indicator

In contrast, the Stochastic Oscillator reflects the level of the close relative to the lowest low. %R corrects for the inversion by multiplying the raw value by -100. As a result, the Fast Stochastic Oscillator and Williams %R produce the exact same lines, only the scaling is different. Moving Average Divergence Convergence indicator does not understand the term “critical zones” and is not suitable for estimating overbought/oversold levels. For trend trading, this is advantageous – all false noises are cut off, but for scalping, the entry point lags. This information has been prepared by IG, a trading name of IG Markets Limited.

Best Indicators to Use With RSI – Investopedia

Best Indicators to Use With RSI.

Posted: Sat, 25 Mar 2017 17:59:47 GMT [source]

Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

eMACD Trading Advisor

The PVO measures the difference between two volume-based moving averages as a percentage of the larger moving average. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Focus on a few that you think are best suited to what you’re trying to achieve. You should also use technical indicators alongside your own assessment of the movements of an asset’s price over time (the ‘price action’). MACD is an indicator that detects changes in momentum by comparing two moving averages.

10 trading indicators every trader should know – IG International

10 trading indicators every trader should know.

Posted: Tue, 04 Jun 2019 19:07:54 GMT [source]

It works on a scale of 0 to 100, where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Traders can use this information to gather whether an upward or downward trend is likely to continue. Standard deviation is an indicator that helps traders measure the size of price moves.

MACD can seem complicated at first glance, because it relies on additional statistical concepts such as the exponential moving average . But fundamentally, MACD helps traders detect when the recent momentum in a stock’s price may signal a change in its underlying trend. This can help traders decide when to enter, add to, or exit a position. Traders will often combine this analysis with the RSI or other technical indicators to verify overbought or oversold conditions. Moving average convergence/divergence (MACD, or MAC-D) is a trend-following momentum indicator that shows the relationship between two exponential moving averages of a security’s price.

A 9-period dotted simple moving average of the MACD is then plotted on top of the MACD. The MACD is an extremely popular indicator used in technical analysis. It can be used to identify aspects of a security’s overall trend. Most notably these aspects are momentum, as well as trend direction and duration. What makes the MACD so informative is that it is actually the combination of two different types of indicators.

MACD – Moving Average Convergence Divergence

The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. The translation of ‘Ichimoku’ is ‘one-look equilibrium chart’ – which is exactly why this indicator is used by traders who need a lot of information from one chart. The RSI is a momentum indicator that shows whether an asset is overbought or oversold. It does this by measuring the magnitude of recent price changes (the standard setting is the previous 14 periods – so 14 days, 14 hours, etc.). The data is then displayed as an oscillator that can have a value between 0 and 100.

The MACD lines, however, do not have concrete overbought/oversold levels like the RSI and other oscillator studies. That’s to say an investor or trader should focus on the level and direction of the MACD/signal lines compared with preceding price movements in the security at hand, as shown below. The moving average convergence/divergence (MACD, or MAC-D) line is calculated by subtracting the 26-period exponential moving average from the 12-period EMA. The Schaff Trend Cycle is a charting indicator that is commonly used to identify market trends and provide buy and sell signals to traders. → pandas.core.series.Series¶The Percentage Volume Oscillator is a momentum oscillator for volume.

The period may be configured in different ways , but this article will focus more on daily settings. Still, the MACD settings may be customized to accommodate different trading strategies. Traders use MACD to identify changes in the direction or strength of a stock’s price trend.

Using the fine-tuning of moving averages, MACD indicator can be effectively applied in any market, but it is not recommended to use it without additional signal filtering. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. The width of the band increases and decreases to reflect recent volatility. The closer the bands are to each other – or the ‘narrower’ they are – the lower the perceived volatility of the financial instrument. By using the MA indicator, you can study levels of support and resistance and see previous price action .

If MACD is below its signal line, the histogram will be below the MACD’s baseline. Traders use the MACD’s histogram to identify when bullish or bearish momentum is high—and possibly overbought/oversold. ¶Keltner Channels are a trend following indicator used to identify reversals with channel breakouts and channel direction. Channels can also be used to identify overbought and oversold levels when the trend is flat. Developed by Larry Williams, Williams %R is a momentum indicator that is the inverse of the Fast Stochastic Oscillator. Also referred to as %R, Williams %R reflects the level of the close relative to the highest high for the look-back period.

A StochRSI reading above 0.8 is usually considered overbought, while a value below 0.2 may be considered oversold. A value of 0 means that the RSI is at its lowest value in the measured period . Conversely, a value of 1 represents that the RSI is at its highest value in the measured period. Due to its greater speed and sensitivity, the StochRSI can generate a lot of trading signals that can be tricky to interpret.

The MACD can provide a visual snapshot to help analyze trends, allowing traders to scan charts rapidly. Stochastic MACD – Slow and Fast The “Stochastic MACD – Slow and Fast” indicator combines two popular technical indicators, the Stochastic Oscillator and the Moving Average Convergence Divergence . The Stochastic Oscillator is a momentum indicator that measures the current closing position of an asset relative to its recent price range. The true strength index is a momentum oscillator used to provide trade signals based on overbought/oversold levels, crossovers, and divergence.

Utilice MACD como filtro de tendencias para entrar al mercado

Due diligence is required before relying on these common signals. Signal line crossovers at positive or negative extremes should be viewed with caution. Even though the MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. It takes a strong move in the underlying security to push momentum to an extreme. Even though the move may continue, momentum is likely to slow, and this will usually produce a signal line crossover at the extremities. Volatility in the underlying security can also increase the number of crossovers.

RSI 50 level acts as Zero which is plotted as a Bollinger on chart. The Relative Strength Index is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. When MACD forms a series of two falling highs that correspond with two rising highs on the price, a bearish divergence has been formed. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent price highs and lows.

trading indicators every trader should know

KAMA will adjust when the price swings widen and follow prices from a greater distance. This trend-following indicator can be used to identify the overall trend, time turning points and filter price movements. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time – showing momentum and trend strength. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. However, if a strong trend is present, a correction or rally will not necessarily ensue.